|

|

Annual Report

March, 2007

| CONTENTS | ||||

Letter to Shareholders |

1 |

|||

Stock Performance |

11 |

|||

Company Profile |

14 |

|||

Financial Information |

F-1 |

|||

Corporate Data |

Inside Back Cover |

Certain statements in this Annual Report constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. To the extent that statements in this Annual Report are not recitations of historical fact, such statements constitute forward-looking statements which, by definition, involve risks and uncertainties. In some cases, you can identify these statements by our use of forward-looking words such as "may," "will," "should," "anticipate," "estimate," "expect," "plan," "believe," "predict," "potential," "intend," and other words of similar substance. In particular, statements under "Business," "Risk-Factors," "Properties," "Legal Proceedings," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Quantitative and Qualitative Disclosures About Market Risk" contain forward-looking statements. Where, in any forward-looking statement, we express an expectation or belief as to future results or events, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be achieved or accomplished. The following include some but not all of the factors that could cause actual results or events to differ materially from those anticipated:

These forward-looking statements and such risks, uncertainties and other factors speak only as of the date made, and we expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein, to reflect any change in our expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based. When considering such forward-looking statements, you should keep in mind the factors described in "Risk Factors" and other cautionary statements contained in this Annual Report. Such risk factors and statements describe circumstances which could cause actual results to differ materially from those contained in any forward-looking statement. This Annual Report includes information concerning OpenTV Corp. and other public companies that file reports and other information with the SEC in accordance with the Securities Exchange Act of 1934. Information contained in this Annual Report concerning those companies has been derived from the reports and other information filed by them with the SEC. If you would like further information about these companies, the reports and other information they file with the SEC can be accessed on the Internet website maintained by the SEC at www.sec.gov. Those reports and other information are not incorporated by reference in this Annual Report.

As we discussed last year, Liberty Media's many assets and businesses, potential tax liabilities, and high degree of complexity have caused confusion among investors. This confusion has resulted in our stock trading at a discount to its implied net asset value and has hurt our ability to deliver full value to our shareholders.

In 2006, we made progress in addressing these challenges.

In May, we created two tracking stocks that attributed our assets between Liberty Interactive, a group led by QVC which includes our video and e-commerce assets, and Liberty Capital, a group which primarily represents our investment assets in media, telecom, and technology. These two tracking stocks increased transparency, focused capital efficiency, and gave investors a choice to invest in the stock they prefer.

We also articulated a strategy for each group. Liberty Interactive's strategy is to grow its existing businesses organically and to use its strong free cash flow to make accretive acquisitions and systematically shrink its equity. During 2006 Liberty Interactive had strong operational performance, made two strategic acquisitions, and repurchased nearly $1 billion of common stock. Liberty Capital's strategy is to monetize its non-core holdings tax-efficiently, simplify its assets, and gain greater focus as an operating business. During the year, Liberty Capital made good progress, agreeing to several tax-efficient stock-for-asset exchanges and asset sales including our stakes in News Corp, Court TV, On Command, IDT, CBS and OpenTV. While many of our non-controlled strategic investments have increased in value, it has become clear to us that consolidating, setting strategy for, developing synergies for, having access to the cash flows of, and setting appropriate capitalizations for our businesses is likely to yield the highest public market value for Liberty.

The market responded well to our efforts. Liberty Media's stocks posted a combined return of 30.8% for 2006 compared to a 15.8% gain for the S&P 500 (including dividends). While a good start, the market continues to undervalue our tracking stocks, and a 2007 goal is to further close that gap.

Operating Performance

Liberty Interactive Early in the second quarter, we provided three-year guidance1 for Liberty Interactive of high single-digit to low double-digit revenue growth and low double-digit operating cash flow (OCF2) growth. For this year, performance dramatically exceeded our guidance with Liberty Interactive generating 13% revenue growth and a 19% increase in OCF. These results were driven by outstanding performance at QVC and enhanced by the acquisitions of Provide Commerce and BUYSEASONS.

QVC, Inc. QVC, the global leader in televised home shopping and centerpiece of Liberty Interactive, had another record year. The company produced revenue and OCF

1

growth of 9% and 16% respectively, reflecting ongoing growth in all of its markets and across all product categories. QVC has developed a sustainable business model that features predictable and generally expanding margins, leveragable operating expenses, and high free cash flow.

Mike George took over as President and CEO early in 2006. He continues the company's philosophy of customer respect and brings strong retail and e-commerce expertise. We are fortunate to have him aboard, and the company had a very good year under his thoughtful leadership.

For 2006, QVC revenue was $7.1 billion and operating cash flow expanded to nearly $1.7 billion. Domestic revenue increased 7% to $5 billion, and domestic OCF grew 13% to $1.2 billion. The less penetrated international businesses, which include operations in the United Kingdom, Germany and Japan, grew faster. Overall, QVC International generated revenue of $2.1 billion, a 12% annual increase, and OCF of $426 million, a 26% increase. Online revenue continued to grow in importance and accounted for 20% of domestic revenue and 18% of total revenue in 2006. QVC.com is not only an efficient sales ordering mechanism, but increasingly a rich destination site allowing QVC to maintain a tighter relationship with its customers, and engage them in new ways.

QVC has a compelling value proposition: offer a carefully chosen selection of quality goods (much of them unique to QVC) in a variety of categories, at reasonable prices, with superior customer service. QVC nurtures a loyal customer group by presenting leading third-party and QVC-owned brands in an entertaining video retail environment that fosters a shopping community. This year QVC demonstrated the breadth of its television presence, airing 27 million unique products, and depth of its customer relationships, shipping more than 120 million units to 7.3 million customers in the United States. QVC celebrated its 20th birthday last October and shipped its one-billionth US package this March.

There is an enormous gap in perception between those who have purchased (who tend to have high appreciation for QVC) and those who have not (who tend to view home shopping more negatively). While the core business continues to show good growth prospects, management seeks to draw new customers to the QVC experience. We are considering geographic expansion, new distribution platforms, and branding and programming initiatives.

Other Liberty Interactive Businesses Liberty Interactive also completed the strategic acquisitions of Provide Commerce and BUYSEASONS, and these businesses produced excellent results. Provide Commerce, which we acquired in February 2006, experienced 21% revenue growth and substantially expanded operating margins. The company is carrying strong momentum into Mother's Day when it will partner with QVC to offer an array of flower and plant arrangements that it hopes will appeal to the companies' similar demographics.

2

BUYSEASONS, the largest online-only supplier of costumes, completed 2006 with 39% revenue growth and significantly improved operating margins. The company, which we acquired in August, experienced strong growth during its peak Halloween season and has carried that momentum into 2007.

The value of our investment in InterActiveCorp increased in 2006 while our Expedia investment declined. Together the value grew from $3.6 billion to $4.0 billion. While pleased with their performance and cognizant of our eventual control positions, it is not clear the market will accord us full value for these investments and we continue to explore strategic alternatives to maximize their value for our shareholders.

Liberty Capital As previously described, operating performance has been a smaller part of the story for the investments attributed to Liberty Capital. Over time, operating performance will become more important as we exchange and sell non-strategic investments for cash and controlled operating businesses. Nonetheless, this past year our controlled affiliates performed well.

Starz Entertainment 2006 was a year of important change at Starz.

When the year began, we offered a premium movie service that was primarily delivered on cable and satellite platforms. This continues to be a good business for Starz, and its performance is improving. Starz pay-tv subscribers increased 6% to 15.5 million while Encore subscribers grew 7% to 27.3 million. Total Starz revenue grew 3% to $1.03 billion, as subscriber growth more than offset a decline in the effective rate that resulted from certain of Starz's new fixed-rate affiliation agreements. Starz's OCF grew 9% for the year as revenue growth outpaced operating cost increases. During the year, programming cost increases moderated to 5% while SG&A declined due to a reduction in marketing activity with Starz's affiliates. OCF growth was particularly strong in the fourth quarter as programming expenses declined, a favorable trend that Starz management expects to continue in 2007.

However, television is changing. Rapidly evolving technology and new video distribution services are causing audience fragmentation. Starz management, led skillfully by Bob Clasen, understands the need to transform the business to offer customers compelling entertainment in a changing digital media world. Starz recognizes that it is in the business of audience aggregation regardless of platform. The 2006 transformation included: the launch of Vongo, an Internet subscription movie service; the acquisition of IDT Entertainment, including its television production and distribution, animated film production and home video distribution businesses and; the launch of Overture Films, a motion picture studio that will produce and distribute approximately ten full-length, theatrical films each year. Starz is now an integrated media company that produces a multitude of programming (including owned-content) for distribution on any platform.

3

2007 should be a year of continued growth for the core networks, further programming cost reductions, OCF growth and the successful integration of Starz' new businesses. We look forward to reporting on further Starz successes in our letter to you next year.

Other Liberty Capital Businesses Our 89%-owned subsidiary, TruePosition, continued its deployment of location networks for Cingular and T-Mobile USA, and continued exploring opportunities to offer a series of customer-facing, location-based services. WildBlue, our satellite provider of broadband Internet service, completed its first full year of offering its service for consumer use. The company has had very positive initial response, and as of the end of February 2007 had 130,000 subscribers. In December, Wildblue successfully launched its second satellite which became operational to provide service in March. GSN completed a solid year in 2006, meeting its financial objectives while enhancing its interactivity and the ability to monetize its content through additional platforms such as participation television and online games.

FUN Technologies, a casual and skill gaming company, in which we acquired majority ownership in March, contributed $42 million of revenue. Its 2006 performance was below expectations, due in part to general uncertainty following the passage of the Unlawful Internet Gambling Enforcement Act (UIGEA)3. The market value of FUN's stock declined and Liberty took an impairment charge of $113 million. We remain enthusiastic about this business. To date in 2007, FUN Games, through the integration of its SkillJam and WorldWinner units, has increased per-customer revenues and is exceeding expectations. Our objective is to strengthen FUN through collaboration with many of our programming and distribution affiliates, including GSN.

Acquisitions and Divestitures

We seek to purchase businesses that possess good customer value propositions, strong management teams, attractive financial metrics, and the potential to benefit from an association with our other businesses. During the year we considered numerous acquisition candidates, but our standards are high and the current generosity of the financial markets has given private equity a strong edge. While we believe in the power of financial leverage to reduce taxes, lower capital costs and drive equity returns, we have been reluctant to use as much debt for consolidated subsidiaries as private equity firms use with a segregated portfolio. We remain patient.

Liberty Interactive Despite current market conditions, Liberty Interactive completed two transactions in 2006.

In February, we completed the purchase of Provide Commerce. Provide operates e-commerce websites for perishable goods and offers a unique value proposition by delivering flowers under the Pro Flowers brand directly from grower to consumer. Under Bill Strauss's strong leadership, this business experienced almost 40% annual

4

revenue growth in the five years preceding its acquisition and continued to show strong operating performance over the past year.

In August, we acquired BUYSEASONS, the owner of buycostumes.com, which is adroitly led by Jalem Getz.

We are pleased with both of these acquisitions which we believe were attractive on a stand-alone basis and hope will benefit from joining Liberty Interactive's other retail businesses.

Liberty Capital 2006 was a year in which we made significant progress in tax-efficiently converting passive and non-core investments into cash and operating businesses. Most importantly, in December we agreed to a §355 exchange of our News Corp shares for 38.5% of DirecTV, regional sports networks in Seattle, Denver and Pittsburgh, and $550 million in cash. We expect to close this transaction in mid-2007. While our News position has performed well over the years, as a non-controlled investment with a low tax basis, this investment has been discounted in value within the Liberty Capital share price. We expect to have increased financial flexibility as DirecTV is financially underleveraged and the shares that we are receiving have a significantly higher tax basis than the News shares we are exchanging. More importantly, DirecTV's operating strength and strategic position should accelerate our move to a more focused, stronger operating company. While Liberty has meaningful market capitalization, not since we were associated with TCI have we had meaningful market power. Whether we increase, decrease or maintain our stake in DirecTV, our financial, strategic and operational flexibility should be significantly enhanced by the completion of the News Corp transaction.

We also completed or announced several other Liberty Capital-related transactions. Since we wrote to you last year, we have completed the sale of our stakes in Court TV, OpenTV and On Command. We also completed the exchange of our IDT stock and interests for IDT Entertainment and announced the exchange of our CBS stock for cash and a station in Green Bay, Wisconsin.

These transactions will result in the tax-efficient disposition of about $13.9 billion of non-strategic assets for strategic operating assets and cash of approximately $1.7 billion. We expect to continue this trend in 2007 in an effort to further simplify Liberty Capital and create greater focus.

Capital Structure and Liquidity

Liberty Media's capital structure and liquidity are strong, allowing us to attribute significant financial resources to both Liberty Capital and Liberty Interactive.

Liberty Interactive At year end, Liberty Interactive had attributed cash and liquid investments exceeding $5 billion and debt of $6.4 billion. Excluding the value of our

5

investment positions in InterActiveCorp and Expedia, attributed net debt of $5.5 billion equated to a multiple of 3.3x annual operating cash flow. Given the relatively predictable levels of cash flow generated by QVC and our other businesses, we now believe Liberty Interactive can comfortably sustain attributed debt levels of 4x to 5x OCF. We have significant liquidity to grow organically, complete acquisitions and shrink equity. During 2006, we put this flexibility to use by repurchasing $954 million of Liberty Interactive common stock.

Liberty Capital The Liberty Capital businesses are also in a position of significant financial strength. At year end, including the pending exchange of our News Corp stake, Liberty Capital had attributed to it $18.2 billion of public investments and derivatives and nearly $2.3 billion of cash and liquid investments. Together, at a value of $20.5 billion, these assets are only partially offset by the $4.7 billion face value of attributed debt. This net liquidity provides Liberty Capital with significant flexibility to grow its businesses and will play an important role in our strategic direction.

Historically, we have expressed reluctance to leverage our non-cash flow generating assets to shrink equity, even when we believe the equity is undervalued. However during 2006, Liberty Capital's cash balance increased by nearly $1 billion with more cash likely to be received in 2007. As a result, last month we announced a self tender for $1 billion of LCAPA shares.

How Are We Doing?

In our letter to you last year, we outlined our objectives and our motivations. Let's take a look at some of the statements from last year's annual report and see how things have progressed.

2006 Statement: We need to help the investment and analyst communities focus their attention on the underlying value of our assets. We believe that the most effective way to do this is to create a tracking stock structure that attributes our assets to two groups, Liberty Capital and Liberty Interactive.

Progress to Date: We have made good strides on this front with Liberty Interactive while Liberty Capital remains a work in progress. On the Liberty Interactive side, the creation of the tracking stocks afforded an opportunity for our shareholders to invest in a more pure-play interactive, multi-channel commerce business. QVC, a large and important part of the overall Liberty Media construct, is clearly the lynchpin of the Liberty Interactive assets. As a result, our investors have an opportunity to compare the Liberty Interactive trading value, comprised in large part of QVC, much more clearly with other commerce and internet companies. The implied trading multiple of QVC has improved, but continues to lag poorer-performing specialty retailers and e-tailers, particularly if the focus is on free cash flow generation. Liberty

6

Interactive still has attributed assets that, due to their non-controlled nature, are likely to continue to be discounted by investors. We will work to reduce this discount and believe our efforts, along with continued strong operating performance at QVC, Provide Commerce and BUYSEASONS and optimal capital structure management, will drive long-term growth in the Liberty Interactive common stock.

On the Liberty Capital side, we have made significant progress. At the time we issued the trackers we stated that it would take some time to convert Liberty Capital's attributed assets to a smaller group of strategic, controlled, operating assets. It is this conversion, we believe, that will ultimately cause our investors to focus more clearly on the underlying value of the assets attributed to Liberty Capital. Since the issuance of the Liberty Capital tracking stock, we have completed asset sales and exchanges that demonstrate significant strides toward tax-efficiently simplifying the group of assets attributed to Liberty Capital. This simplification represents a major step toward giving our investors the ability to focus more crisply on this group of assets. We will continue this simplification process in 2007.

2006 Statement: In defining the tracking stock groups, we decided to focus on our largest operating business and highest performer, QVC. With dominant share in video commerce, exceptional free cash flow, and substantial international and e-commerce growth potential, we believe a well-positioned "interactive" vehicle can achieve a high multiple that fully reflects its intrinsic value.... We believe this group, leveraged at three to four times net debt, presents an attractive investment vehicle.

Progress to Date: As discussed above, QVC has an exceptional track record of top-notch execution for over twenty years. The creation of the tracking stock structure has not only given investors a chance to invest more directly in QVC, it has given Liberty a vehicle through which to more clearly present the formula for QVC's success. We hosted a well-attended and well-received investor day at QVC's headquarters in Westchester, Pennsylvania. We believe this and other investor communications clarified the QVC value proposition for many investors and analysts and contributed to an increased level of interest in the business.

As QVC's superior financial metrics become more transparent to investors in Liberty Interactive common stock, it becomes more readily comparable to other specialty retailers and ecommerce companies. We believe QVC shines in comparison and we were aggressive about putting the company's strong cash flow to work in buying Liberty Interactive stock at what we believed to be very attractive valuations. We repurchased nearly $1 billion of LINTA equity in 2006, and yet the group's net debt remained at a modest 3.3x annual operating cash flow.

7

We will continue to evaluate alternative uses of Liberty Interactive's significant free cash flow and expanded borrowing capacity and believe a systematic equity reduction program combined with ongoing organic cash flow growth and strategic acquisitions presents a winning formula for continued strong returns for our shareholders.

2006 Statement: Nonetheless, Liberty Capital will need to trade out of many of its passive equity positions and acquire new businesses or expand its existing businesses. The redeployment of this large equity base represents the greatest opportunity to re-direct the Liberty Capital Group.

Progress to Date: As outlined above, it has been an active year and the transactions we have completed show great progress toward redirecting the group. We have monetized a number of non-strategic assets and reached agreement to acquire several businesses, most notably 38.5% of DirecTV, that will anchor Liberty Capital's strategic foundation going forward. Frankly, we got much more done in 2006 than either of us would have guessed possible a year ago. In 2007 we expect to further streamline Liberty Capital's attributed assets and make strategic acquisitions around our core operating companies.

2006 Statement: We believe this strategy gives us significant flexibility in capital structure and investment opportunities....We believe we will be in a much stronger position to actively manage the balance sheets of both groups. This should enable us to fund growth initiatives while repurchasing equity at prices and under circumstances we deem appropriate.

Progress to Date: As previously noted, we systematically conducted open market purchases of Liberty Interactive common stock throughout the year. This allowed us to repurchase 7.3% of the outstanding LINTA shares during the year at a weighted average price of $18.49 per share. This is a formula that we believe is sustainable and we will continue to pursue as valuations warrant. These repurchases do not, however, preclude us from reinvesting in our existing businesses or making strategic acquisitions and, in fact, we made two such purchases in 2006. We will continue to seek additional strategic transactions to attribute to Liberty Interactive.

The strengthening of our balance sheet through asset sales and exchanges in 2006 allowed us to initiate a self-tender offer for $1 billion of Liberty Capital common stock in early 2007. Such action could be repeated in the future should similar circumstances arise. Additionally, we will continue to seek acquisitions of businesses that we believe are strategically important to the ongoing assets attributed to Liberty Capital.

8

2006 Statement: While we think that the peak market capitalization we attained in 2000 was unrealistic we also believe the combined value...today is too low...We believe that it puts us in a good position to simplify Liberty Capital and create new avenues for growth, while expanding Liberty Interactive through organic growth, strategic acquisitions and business development.

Progress to Date: We are making progress on this front and as of the writing of this letter the combined market capitalization of Liberty Capital and Liberty Interactive has reached $30 billion, up from $23 billion when we announced the tracking stocks, despite the repurchase of $1 billion of stock. And we believe we can do more. Most observers believe that Liberty Capital common stock continues to trade at a discount to its underlying asset value (and we agree). Similarly, Liberty Interactive common stock trades at a level that implies an operating cash flow multiple of QVC well below that of its peers. We will continue to undertake strategies that we believe will drive value for our shareholders of both groups with the goal of continuing the stock price momentum that was generated in 2006.

2007 and Beyond

We are pleased with the progress we made in 2006 and hope you are too. We had more activity than in recent years and believe it was productive. While significant strategic questions remain, we have better options and more ability to accomplish our goals.

While in 2007, QVC, Starz, Provide, FUN, BUYSEASONS, TruePosition, and all our controlled affiliates focus on their operating growth and efficiency, we will continue to work on setting a robust strategic direction, simplifying our portfolio, making strategic acquisitions, managing our balance sheet and creating a more focused operating company.

We are enthused by our prospects and confident that Liberty Media is continuing down the right path to maximize shareholder returns. Thank you for your support.

Very truly yours,

|

|

|

| Gregory B. Maffei President and Chief Executive Officer |

John C. Malone Chairman of the Board |

|

9

10

The following graph compares the historical combined performance of the Liberty Capital Series A and Liberty Interactive Series A tracking stocks and their predecessor securities from August 1995 through December 31, 2006, in comparison to our peers (News Corporation, CBS Corporation, The Walt Disney Company and Time Warner Inc.). The predecessor securities are comprised of (1) Tele-Communications Inc. Series A Liberty Media Group tracking stock (Nasdaq trading symbol: LBTYA) for the period from August 1995 until March 1999, (2) AT&T Corp. Class A Liberty Media Group tracking stock (NYSE trading symbol: LMG.A) for the period from March 1999 until August 2001, and (3) the former Liberty Media Corporation Series A common stock (NYSE trading symbol: originally LMC.A but subsequently changed to L) for the period from August 2001 until the May 9, 2006 restructuring (in which such stock was exchanged for our Liberty Capital Series A and Liberty Interactive Series A tracking stocks).

Historical Performance of Pre-and Post-Restructuring Liberty Compared to Peers |

|||

|

|||

| *Including predecessor securities | |||

11

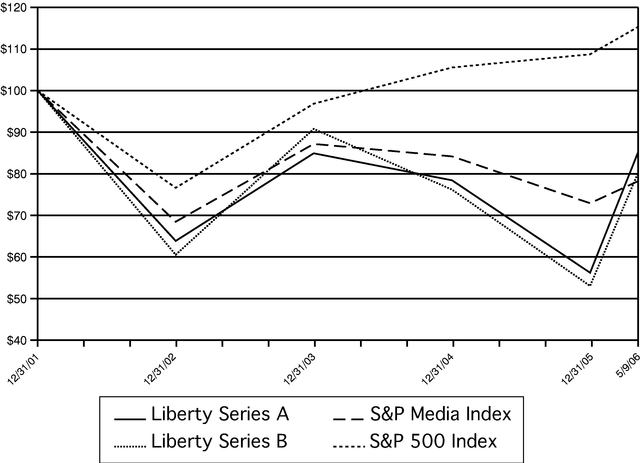

The following graph compares the yearly percentage change in the cumulative total shareholder return on the former Liberty Media Corporation Series A (NYSE trading symbol: L) and Series B common stock (NYSE trading symbol: LMC.B) from December 31, 2001 through the May 9, 2006 restructuring, in comparison to the S&P 500 Media Index, which reflects the performance of companies in our peer group, and the S&P 500 Index. We have included in the returns presented below the estimated values attributable to the dividends paid in connection with the June 2004 spin off of Liberty Media International Inc. and the July 2005 spin off of Discovery Holding Company.

Historical Performance of Pre-Restructuring Liberty Compared to Select Indices |

||

|

||

12/31/01 |

12/31/02 |

12/31/03 |

12/31/04 |

12/31/05 |

5/9/2006 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Liberty Series A | 100.00 | 63.86 | 84.93 | 78.43 | 56.21 | 85.64 | ||||||

| Liberty Series B | 100.00 | 60.53 | 90.79 | 76.18 | 53.03 | 80.66 | ||||||

| S&P Media Index | 100.00 | 68.48 | 87.18 | 84.18 | 72.92 | 78.31 | ||||||

| S&P 500 Index | 100.00 | 76.63 | 96.85 | 105.56 | 108.73 | 115.42 |

12

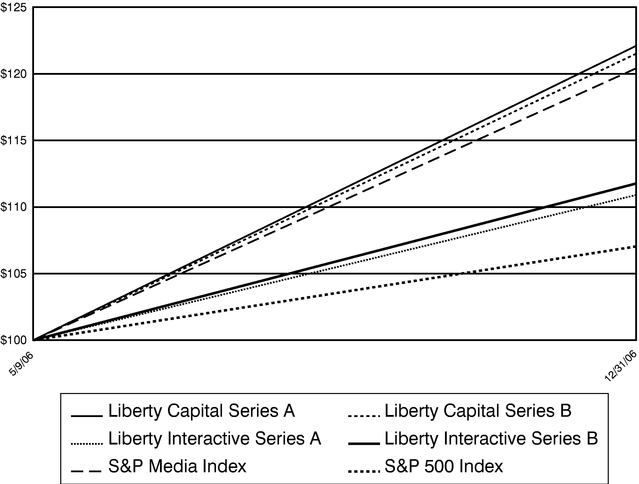

The following graph compares the percentage change in the cumulative total shareholder return on each of the Liberty Capital Series A and Series B tracking stocks and the Liberty Interactive Series A and Series B tracking stocks from May 10, 2006 through December 31, 2006, in comparison to the S&P 500 Media Index and the S&P 500 Index.

Historical Performance of Post-Restructuring Liberty Compared to Select Indices |

||

|

||

5/10/2006 |

12/31/2006 |

|||

|---|---|---|---|---|

| Liberty Capital Series A | 100.00 | 122.09 | ||

| Liberty Capital Series B | 100.00 | 121.50 | ||

| Liberty Interactive Series A | 100.00 | 110.90 | ||

| Liberty Interactive Series B | 100.00 | 111.76 | ||

| S&P Media Index | 100.00 | 120.41 | ||

| S&P 500 Index | 100.00 | 107.03 |

13

Liberty Media Corporation is a holding company that owns interests in a broad range of electronic retailing, media, communications and entertainment businesses. Those interests are attributed to two tracking stock groups: Liberty Interactive, which includes Liberty Media's interests in QVC, Provide Commerce, BUYSEASONS, IAC/InterActiveCorp and Expedia, and Liberty Capital, which includes all of Liberty Media's assets that are not attributed to Liberty Interactive, including Liberty Media's interests in Starz Entertainment and News Corporation.

The following table sets forth Liberty Media's assets that are held directly and indirectly through partnerships, joint ventures, common stock investments and instruments convertible into common stock. Ownership percentages in the table are approximate and, where applicable, assume conversion to common stock by Liberty Media and, to the extent known by Liberty Media, other holders. In some cases, Liberty Media's interest may be subject to buy/sell procedures, repurchase rights or, under certain circumstances, dilution.

| ENTITY |

SUBSCRIBERS AT 12/31/06 (000's) |

SUBSCRIBERS AT 12/31/05 (000's) |

SUBSCRIBERS AT 12/31/04 (000's) |

YEAR LAUNCHED |

ATTRIBUTED OWNERSHIP AT 12/31/06 |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| OPERATING BUSINESSES | |||||||||||||

GSN |

60,887 |

57,805 |

56,411 |

1994 |

50 |

% |

|||||||

Starz Entertainment LLC |

100 |

% |

|||||||||||

| Encore | 27,323 | 25,784 | 24,457 | 1991 | |||||||||

| MOVIEplex | 14,696 | 11,892 | 3,925 | 1995 | |||||||||

| Thematic Multiplex (aggregate units)(1) | 150,027 | 140,459 | 130,349 | ||||||||||

| Love Stories | 1994 | ||||||||||||

| Westerns | 1994 | ||||||||||||

| Mystery | 1994 | ||||||||||||

| Action | 1994 | ||||||||||||

| True Stories | 1994 | ||||||||||||

| WAM! | 1994 | ||||||||||||

Starz |

15,521 |

14,082 |

14,108 |

1994 |

|||||||||

| Starz Edge(1) | 1996 | ||||||||||||

| Starz InBlack(1) | 1997 | ||||||||||||

| Starz Kids & Family(1) | 1999 | ||||||||||||

| Starz Cinema(1) | 1999 | ||||||||||||

| Starz Comedy(1) | |||||||||||||

14

| ENTITY |

BUSINESS DESCRIPTION |

ATTRIBUTED OWNERSHIP AT 12/31/06 |

|||

|---|---|---|---|---|---|

| OPERATING BUSINESSES | |||||

Hallmark Entertainment Investments Co. |

Hallmark Entertainment Investments Co. owns 80.2% of Crown Media Holdings, Inc. Class A common stock and 100% of the Class B common stock, representing 96.1% of the total outstanding voting power of Crown Media Holdings, Inc. Stockholders of Hallmark Entertainment Investments Co. are Hallmark Entertainment Holdings, Inc., Liberty Media Corporation, J.P. Morgan Partners (BHCA), L.P. and National Interfaith Cable Coalition, Inc. ("NICC"). |

11 |

%(2) |

||

MacNeil/Lehrer Productions |

Produces "NewsHour" with Jim Lehrer and Robert MacNeil in addition to documentaries, Web sites, interactive DVD's, civic engagement projects and educational programs. |

67 |

% |

||

News Corporation (NYSE: NWS, NWS.A) |

Entertainment company operating in eight industry segments: filmed entertainment; television; cable network programming; direct broadcast satellite television; magazines and inserts; newspapers; book publishing; and other. The activities of News Corporation are conducted principally in the United States, Continental Europe, the United Kingdom, Australia, Asia and the Pacific Basin. |

16 |

%(3) |

||

15

| ENTITY |

BUSINESS DESCRIPTION |

ATTRIBUTED OWNERSHIP AT 12/31/06 |

|||

|---|---|---|---|---|---|

| OPERATING BUSINESSES | |||||

Current Communications Group |

Developing Broadband over Power Line (BPL) technology and solutions through its two subsidiaries, Current Communications and Current Technologies. |

16 |

% |

||

FUN Technologies Inc. (TSX/AIM: FUN) |

Online and interactive casual games provider. Provides cutting-edge gaming systems to top distribution partners around the world. |

53 |

% |

||

GoPets, Ltd. |

Virtual community of pets that interact with each other and other users all over the world. Currently in an open beta phase in fifteen languages and eight territories around the world. |

25 |

% |

||

On Command Corporation |

Provider of in-room interactive entertainment, Internet access, business information and guest services for the lodging industry. |

100 |

%(4) |

||

Sling Media |

Consumer hardware and application company that turns any Internet-connected PC, Mac, or mobile device into your home television. |

6 |

% |

||

TruePosition, Inc. |

Provider of wireless location technology and services. |

89 |

% |

||

Wildblue Communications, Inc. |

Ka-band satellite network focused on providing broadband services to homes and small offices in North America. |

32 |

% |

||

16

| ENTITY |

BUSINESS DESCRIPTION |

ATTRIBUTED OWNERSHIP AT 12/31/06 |

|||

|---|---|---|---|---|---|

| PUBLICLY TRADED INVESTMENTS—FINANCIAL | |||||

CBS Corporation |

Mass media company serving audiences and advertisers domestically and internationally. Operates in virtually every field of media and entertainment, including broadcast television, cable television, local television, television production and syndication, radio, advertising on out-of-home media, publishing, digital media and comsumer products. |

1 |

%(5) |

||

Embarq Corporation (NYSE: EQ) |

Provides a suite of communications services to customers in its local services territories. Offers local and long distance voice, data, high speed internet, wireless and entertainment services. |

3 |

% |

||

Motorola, Inc. (NYSE: MOT) |

Provider of integrated communications solutions and embedded electronic solutions. |

3 |

% |

||

priceline.com, Incorporated (Nasdaq: PCLN) |

Provider of e-commerce service allowing consumers to make offers on products and services. |

1 |

% |

||

Sprint Nextel (NYSE: S) |

Offers a comprehensive range of communications services bringing mobility to consumer, business and government customers. |

3 |

%(6) |

||

Time Warner Inc. (NYSE: TWX) |

Media and entertainment company whose businesses include filmed entertainment, interactive services, television networks, cable systems, music and publishing. |

4 |

% |

||

Viacom Inc. (NYSE: VIA) |

Global media company, with positions in broadcast and cable television, radio, outdoor advertising, and online. Brands include CBS, MTV, Nickelodeon, Nick at Nite, VH1, BET, Paramount Pictures, Infinity Broadcasting, Viacom Outdoor, UPN, TV Land, Comedy Central, CMT: Country Music Television, Spike TV, Showtime, Blockbuster, and Simon & Schuster. |

1 |

% |

||

17

| ENTITY |

BUSINESS DESCRIPTION |

ATTRIBUTED OWNERSHIP AT 12/31/06 |

|||

|---|---|---|---|---|---|

| OPERATING BUSINESSES | |||||

BUYSEASONS, Inc. |

Online retailer of costumes and accessories |

100 |

% |

||

Provide Commerce |

E-commerce market place providing a collection of branded websites each offering high quality, perishable products shipped directly from the supplier to the consumer and designed specifically around the way consumers shop. |

100 |

% |

||

QVC, Inc. |

An electronic retailing leader, marketing a wide variety of brand name products in such categories as home furnishing, licensed products, fashion, beauty, electronics and fine jewelry. |

100 |

% |

||

18

| ENTITY |

BUSINESS DESCRIPTION |

ATTRIBUTED OWNERSHIP AT 12/31/06 |

|||

|---|---|---|---|---|---|

| PUBLICLY TRADED INVESTMENTS—STRATEGIC | |||||

Expedia, Inc. (Nasdaq: EXPE) |

Empowers business and leisure travelers with the tools and information needed to research, plan, book and experience travel. It also provides wholesale travel to offline retail travel agents. Expedia's main companies include: Expedia.com, Hotels.com, Hotwire, Expedia Corporate Travel, TripAdvisor and Classic Vacations. Expedia's companies operate internationally in Canada, the UK, Germany, France, Italy, the Netherlands and China. |

20 |

%(7) |

||

IAC/InteractiveCorp (Nasdaq:IACI) |

Operates businesses in sectors being transformed by the internet, online and offline. IAC is comprised of HSN; Cornerstone Brands, Inc.; HSE24; Shoebuy.com; Ticketmaster; Lending Tree; RealEstate.com; ServiceMagic; Match.com; Entertainment Publications; Interval International; Ask.com; Citysearch; Evite; Gifts.com; iBuy; Pronto; and CollegeHumor. |

24 |

%(8) |

||

19

CORPORATE DATA

Board of Directors

John C. Malone

Robert R. Bennett

Donne F. Fisher

Paul A. Gould

Gregory B. Maffei

David E. Rapley

M. LaVoy Robison

Larry E. Romrell

Executive Committee

Paul A. Gould

Gregory B. Maffei

John C. Malone

Compensation Committee

Donne F. Fisher

Paul A. Gould

David E. Rapley

M. Lavoy Robison

Larry E. Romrell

Audit Committee

Donne F. Fisher

Paul A. Gould

David E. Rapley

M. Lavoy Robison

Nominating & Corporate Governance Committee:

Donne F. Fisher

Paul A. Gould

David E. Rapley

M. Lavoy Robison

Larry E. Romrell

Incentive Plan Committee:

Donne F. Fisher

Paul A. Gould

Section 16 Exemption Committee:

Donne F. Fisher

Paul A. Gould

Officers

John C. Malone

Chairman of the Board

Gregory

B. Maffei

President and CEO

Charles

Y. Tanabe

Executive Vice President

Secretary

and General Counsel

Mark

D. Carleton

Senior Vice President

William

R. Fitzgerald

Senior Vice President

David

J. A. Flowers

Senior Vice President

and Treasurer

Albert

E. Rosenthaler

Senior Vice President

Christopher

W. Shean

Senior Vice President

and Controller

Michael P.

Zeisser

Senior Vice President

Corporate Headquarters

12300 Liberty Boulevard

Englewood, CO 80112

(720) 875-5400

Stock Information

Liberty Interactive Group

Series A and Series B Common

Stock (LINTA/B) and Liberty

Capital Group Series A and

Series B Common Stock

(LCAPA/B) trade on NASDAQ.

CUSIP Numbers

LINTA—53071M 10 4

LINTB—53071M 20 3

LCAPA—53071M 30 2

LCAPB—53071M 40 1

Transfer Agent

Liberty Media Shareholder Services

c/o Computershare

P.O. Box 43023

Providence, RI 02940-3023

Phone: 781-575-4593

Tollfree: 866-367-6355

www.computershare.com

Telecommunication Device

for the Deaf (TDD)

800-952-9245

Investor Relations

877-772-1518

John

Orr

Reggie Salazar

reggie@libertymedia.com

Liberty on the Internet

Visit Liberty's web site at

www.libertymedia.com

Financial Statements

Liberty Media Corporation

financial statements are filed

with the Securities and

Exchange Commission.

Copies of these financial

statements can be obtained

from the Transfer Agent or

through Liberty's web site.

Liberty Media Corporation

12300 Liberty Boulevard

Englewood, CO 80112

720.875.5400

www.libertymedia.com

LM-AR-07